Most SaaS companies leave significant revenue on the table during their free trial phase. While industry benchmarks show that the average SaaS trial-to-paid conversion rate hovers between 14-25%, top-performing companies consistently achieve 40-60% or higher. The gap isn’t due to better products or larger marketing budgets. It comes down to execution. Understanding conversion benchmarks, identifying where your funnel bleeds users, and implementing strategic interventions can transform your trial experience from a leaky bucket into a revenue engine.

Why Trial-to-Paid Conversion Matters for Your SaaS Growth

Your free trial is not just an onboarding stage. It’s your first real revenue-generating asset. Every user who doesn’t convert represents lost lifetime value, increased customer acquisition cost per paying customer, and reduced predictability in your cash flow. The stakes are higher than most founders realize.

Research shows that companies improving their trial conversion by just 5 percentage points can see dramatic improvements in their overall metrics. A product with 500 trial signups and a 10% conversion rate generates 50 customers. Improve that to 15%, and you suddenly have 75 customers from the same traffic. That’s a 50% revenue increase without spending more on acquisition. This is why conversion optimization during trials should be a top priority, not an afterthought.

The challenge is that most teams operate on assumptions rather than data. They assume users will see value in their product, or they believe their pricing page copy is convincing. Community discussions on Reddit and other forums reveal a consistent pattern: founders with low conversion rates are making the same mistakes repeatedly. They’re not asking users why they’re leaving. They’re not tracking where friction occurs. They’re optimizing for vanity metrics like sign-up volume instead of meaningful engagement metrics that predict conversion.

Understanding SaaS Trial Conversion Benchmarks

Before you can improve your conversion rate, you need context for where you stand. Trial conversion benchmarks vary significantly based on trial type, product category, and go-to-market model.

Opt-in versus opt-out trials tell a fundamentally different story. An opt-in trial requires a credit card upfront, creating friction but filtering for genuine intent. These trials convert at approximately 15-25%. Opt-out trials, where users access premium features without payment information, convert at a much lower 5-15% - but start with a larger top-of-funnel volume. B2B SaaS companies using opt-in models typically see conversions between 15-30%, while B2C companies average 10-20%.

Trial length significantly impacts immediate conversion but not always in the way founders expect. Shorter trials of 7 days or less show the highest immediate conversion rates at around 40%, driven by urgency. However, extended trial periods of 30 days increase overall subscription rates through delayed conversion, as users get more time to become dependent on the product. The research shows that longer trials increase trial adoption by 11% and delayed conversion by 42%, but don’t significantly improve immediate conversion during the trial period itself.

By vertical, conversion rates vary widely. CRM software averages 29% trial-to-paid conversion. HR tech sits around 19%. Developer tools, where users can quickly assess value, consistently hit 25-40%. Marketing technology averages 18%. These differences reflect how quickly users experience value and how clearly products solve their specific problems.

The Root Causes of Trial Abandonment: Pain Points Your Users Are Experiencing

When users don’t convert, it’s rarely random. Patterns emerge when you examine the data. Community forums and customer research reveal several consistent pain points that drive trial abandonment.

The missing “aha moment” is the number one killer. Users sign up, they explore, but they never reach that critical moment where they think, “This is solving my problem.” Data shows that users who interact with core features in their first 3 days are 4 times more likely to convert than those who don’t. Yet nearly 90% of apps get downloaded, opened once, and never used again. The median time from sign-up to the aha moment is the critical window. If your product takes 5 days for users to experience value, but most abandon by day 3, you’ve already lost them.

Slow time-to-value is the second barrier. One founder in community discussions mentioned that their competitor required 5-10 minutes to create their first output, while their own product did it in under 30 seconds. The result? 90% activation rate versus struggling conversions elsewhere. When users have to complete setup steps, integrate data, or configure settings before seeing results, friction compounds with doubt. They question whether the product is worth their time.

Onboarding friction creates invisible leaks. Complex signup flows, confusing interfaces, and unclear instructions don’t kill conversion in one moment. They kill it through a thousand papercuts. Intercom research found that users who complete an onboarding flow are 5 times more likely to convert than those who don’t. Yet most founders design onboarding as a checklist to collect data, not as a pathway to value. When your onboarding asks for 15 form fields instead of 3, or when setup requires inviting teammates before users can see a single result, you’re losing conversions.

Misalignment between expectations and reality creates the value gap. A user signs up because your landing page promises X capability. During the trial, they discover that feature exists but only in the premium tier. Or it works differently than expected. Or it’s surrounded by so many other features that the core value disappears in complexity. This expectation mismatch converts trial visitors into churn.

Pricing and perceived value don’t align. When your price appears disconnected from the problem users are solving, conversion tanks. If your product solves an infrequent need, users won’t justify a monthly subscription. If your pricing model doesn’t match how users actually use the product, they’ll churn. This is a particularly common pattern in B2C where free-trial-to-paid converts at 2-5% because users have inexpensive alternatives and don’t feel urgency.

Benchmarks by Trial Length: The Urgency vs. Depth Trade-off

Trial length is a strategic decision with measurable consequences. The research is surprisingly clear, though the implications are more nuanced than “shorter is better.”

Short trials (7 days or less) generate urgency. They force users to prioritize your product over their other tasks. Immediate conversion rates peak at around 40%. However, if your product requires stakeholder buy-in or complex setup, 7 days isn’t enough time. You’ll see high drop-off during the trial period itself.

Medium trials (14-21 days) balance urgency with learning time. This duration works well for moderately complex products where users need a week to activate, then another week to decide. Your conversion window opens after the aha moment, not before.

Longer trials (30 days or more) reduce immediate conversion pressure but increase overall conversion through delayed decision-making. Users become dependent on the product, integrate it into their workflows, and feel loss aversion when the trial expires. The study data shows that extending from 7 days to 30 days increases delayed conversion by 42%. However, this only works if your activation metrics are tracked. Without proactive engagement, longer trials just become longer periods of non-use.

The strategic move isn’t picking one length for everyone. Instead, offer a one-time trial extension to genuinely engaged users. If a user is logging in regularly and hitting core features, they’re showing intent. An extra week might convert them. If a user never logs in after day 1, more time won’t help. You need behavioral data to make this decision.

What Top Converters Do Differently: Actionable Benchmarks

The SaaS companies hitting 40-60% trial conversion rates aren’t doing anything magical. They’re executing fundamentals flawlessly.

First, they nail onboarding speed. Top performers get users to their first meaningful action in under 24 hours. This isn’t a 30-minute tutorial. It’s a 3-5 minute guided path that results in a completed task. Slack’s famous discovery that teams sending 2,000 messages were far more likely to stay became their north star. They optimized onboarding around reaching that threshold quickly. Notion uses interactive checklists that teach through action. Zapier gets you to create your first automation within minutes.

Second, they segment and personalize aggressively. Instead of the same onboarding for everyone, they ask lightweight qualifying questions. “Are you evaluating for personal use or team use?” “Is speed more important to you than features?” “Have you used competing products?” These answers shape the trial experience. Users see examples and defaults relevant to their use case, not a generic product tour.

Third, they use strategic email sequences tied to behavior. Behavior-based email sequences outperform time-based sequences by 30%. This means: if a user signs up but never logs in by day 2, they get a different email than a user who logged in but didn’t complete a core task. The emails highlight what they’re missing, show how peers are using the product, or offer personalized onboarding help.

Fourth, they remove friction from the upgrade path. The best trial experiences make upgrading frictionless. One company removed 3 form fields from their payment page and increased conversions by 8%. Others auto-fill pricing suggestions based on observed usage. The goal: the moment a user decides to upgrade, nothing slows them down.

Fifth, they measure activation before conversion. Companies tracking feature adoption, first action completion, and time-to-value in real-time can intervene before users churn. If your data shows that users who create a project in their first 48 hours convert at 60%, while those who don’t convert at 10%, you know exactly what to optimize for. You build onboarding around project creation, you push users toward it, you celebrate when they complete it.

Implementing Feedback Collection to Diagnose Your Specific Leaks

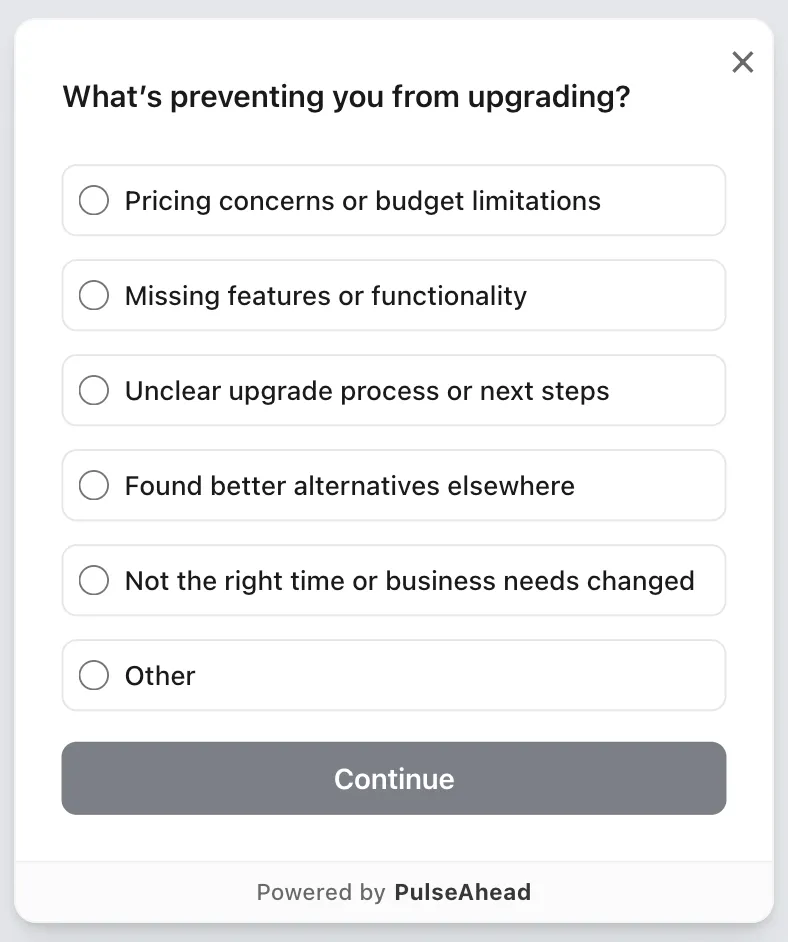

Understanding generic benchmarks is useful. Understanding why your users don’t convert is essential. This is where in-product feedback becomes invaluable, and tools like PulseAhead excel by allowing you to capture user sentiment at critical moments. With a targeted Trial-to-Paid Conversion Survey, you can ask users at the end of their trial: “What’s preventing you from upgrading?” A simple multiple-choice question with an open-text option reveals whether the issue is pricing, missing features, complexity, or perceived value mismatch.

Trial to Paid Conversion Survey Example using PulseAhead

Exit-intent surveys capture the moment before churn. When a user initiates cancellation, ask why. These responses are gold. Users are about to leave, so they’re often honest. They might reveal that your product solves only 30% of their problem, or that they found a cheaper alternative, or that setup took longer than expected. Each response points to a specific fix.

Session recordings of churned users show exactly where they got stuck. Watch 20-30 sessions of users who abandoned within their first week. Note where they pause, where they click back, where confusion appears. These behavioral signals matter more than assumptions.

Free trial users are willing to give feedback if you ask at the right moment. Rather than sending a generic post-trial survey after they churn, offer feedback users a one-week trial extension in exchange for a 5-minute call or survey. Engaged users will take this trade. You learn why they’re considering churn, and they get more time to find value. It’s a win for both sides.

Your Conversion Improvement Plan

Improving trial conversion doesn’t require a complete rebuild. Most improvements come from compounding small fixes. Here’s a practical framework.

Audit and establish baselines. Calculate your current conversion rate at each stage: visitor-to-trial signup, trial signup-to-activation (first meaningful action), activation-to-paid. Set up tracking for feature adoption and time-to-value. This is your baseline. Every future change is measured against it.

Remove obvious friction. Reduce your signup form to 3-4 essential fields. Fix broken links, typos, and confusing microcopy. Implement one clear onboarding path that gets users to their aha moment in under 24 hours. Test this with 50 signups and measure the impact. This alone typically improves conversion by 5-10%.

Optimize the activation experience. Implement in-product surveys or feedback tools to understand which features users attempt and which they skip. Send personalized email nudges that highlight underused features relevant to their use case. Test different trial lengths for different user segments. Create a “next action” prompt that suggests what users should do next, reducing decision paralysis.

Test conversion incentives and messaging. Run A/B tests on upgrade prompts, offer messaging, and pricing presentation. Test urgency tactics like countdown timers on your trial. Segment users by engagement level and send tailored conversion messages. For highly engaged users, offer early-bird pricing. For at-risk users, offer a trial extension. For passive users, send case studies showing how peers solved similar problems.

Measure and report. Compare your conversion rates to week 2 baselines. Most teams see 15-40% improvements in trial-to-paid conversion after this framework. Identify what worked, what didn’t, and plan the next cycle.

Using Customer Feedback at Scale to Inform Your Trial Strategy

One pattern emerges consistently in high-converting SaaS companies: they’ve built feedback collection into their trial experience. Rather than treating feedback as a post-hoc chore, it’s embedded in the product.

Implementing in-product surveys at key moments - after users complete their first action, when they use advanced features, and at trial conclusion captures unfiltered feedback while context is fresh. PulseAhead makes this seamless with customizable, embeddable surveys that feel native to your product. The data reveals not just what users think, but when they think it. A user who dislikes the interface after 10 minutes has different friction than one who gets frustrated after 3 days of heavy use.

This feedback also fuels iteration. If 40% of surveyed users mention pricing as a barrier, that’s your signal to test tiered options. If 30% mention integration challenges, you’ve identified a product gap. If 20% simply didn’t understand the value, your messaging is the culprit.

Smart teams use this feedback data to inform their conversion funnel continuously. Each cohort of trial users teaches you something. You implement that lesson, measure the impact, and keep compounds improvements. This is how conversion rates go from 15% to 25% to 35%.

Skip the guesswork. Start with ready-made Pulseahead templates.

Conclusion: Convert More Without Changing Your Product

The trial-to-paid conversion crisis isn’t about product quality. It’s about clarity, friction, and timing. Most founders can increase their trial conversion rate by 20-40% without modifying a single product feature. They just need to nail the fundamentals: reduce time-to-value, create urgency without being aggressive, ask users why they’re leaving, and remove friction from the conversion path. This is precisely what PulseAhead is designed for, our platform gives you the tools to ask the right questions at the right time, turning user feedback into actionable conversion insights.

Start by establishing your baselines. Where do your trial users drop off? Why? Then iterate systematically. Each 5% improvement in conversion is revenue that compounds. And unlike acquisition, conversion improvements benefit every future cohort of users indefinitely.

The companies dominating their categories aren’t the ones with the best products. They’re the ones who’ve optimized their trial experience to guide users from sign-up to aha moment to paid subscriber as efficiently as possible. That discipline is learnable, measurable, and within reach of any SaaS team.