Here’s a hard truth: by the time a customer tells you they’re not renewing, it’s often too late. The real conversation happens silently in product usage patterns, support ticket flows, and unspoken frustrations. The window to save them closes fast.

The good news? You don’t need a crystal ball to see it coming. Customers leave breadcrumbs, and pre-expiration feedback is the clearest map to their exit. This is where you catch renewal risks early, when intervention still works.

The Silent Spiral: Why Customers Don’t Tell You They’re Leaving

Most churn doesn’t announce itself loudly. Between 10 and 20% of SaaS churn is involuntary (failed payments, expired cards), but the bigger problem is voluntary churn masked by silence. Customers don’t always tell you why they’re canceling. They just disappear.

Here’s what actually happens: A customer’s usage quietly drops. Their support tickets decrease, not because everything’s fine, but because they’ve stopped caring. Key team members leave their organization, taking your relationship with them. New stakeholders arrive, fresh and skeptical, questioning why they’re paying for something they don’t fully understand.

By renewal time, the decision is already made. It happened over weeks or months without a single conversation.

This is where proactive feedback becomes your competitive advantage. Instead of waiting for the renewal meeting to happen, you’re listening to signals months in advance. You’re asking the right questions before it’s too late to answer them.

The 90-Day Window: Your Real Retention Timeline

Research from top SaaS companies shows a consistent pattern: starting renewal conversations 90 days before expiration changes everything. Companies that begin this early achieve 15 to 20% higher renewal rates than those waiting until the last month.

But here’s what’s critical: this window isn’t for paperwork. It’s for feedback.

The 90-day mark is where you stop guessing and start gathering intelligence. You’re running targeted surveys, analyzing product adoption metrics, and collecting sentiment before the contract expires. You’re asking customers directly: Are you getting value? What’s broken? What’s missing?

This timing matters because it gives you time to act. If you discover issues at 30 days, your options are limited. Discounts feel desperate. Promises of improvements feel hollow. But at 90 days? You can actually fix things. You can ship improvements. You can prove your commitment.

Smart teams break this window into three distinct phases: health assessment at 90 days, deeper engagement at 60 days, and final conversations at 30 days. Each phase has a purpose, and feedback collection sits at the center of each.

Reading the Room: The Data Signals That Predict Churn

Before you even send a survey, the data is already telling stories. The trick is knowing which ones matter.

Product usage patterns are your first warning system. Customers who drop usage by more than 50% are flagging themselves as at-risk. Not tomorrow, but this quarter. Key feature adoption is equally telling. If customers aren’t using core functionality after 30 days, they’re unlikely to renew.

Support ticket volume shifts the narrative too. Multiple tickets in a short time, especially about the same problem unresolved, signals frustration. But here’s the counterintuitive part: no support tickets at all can also be a red flag. It might mean the customer stopped trying to get help and is quietly walking away.

Then there’s the health score, which synthesizes all of this into one number. It combines usage frequency, feature adoption, support interactions, NPS responses, and payment history into a predictive indicator. A declining health score is your early warning system.

But data tells you what happened. Feedback tells you why it happened, and that’s where your retention strategy actually works.

Asking the Right Questions: Pre-Renewal Feedback That Converts

A poorly timed survey kills two things: your response rate and your credibility. But a strategically timed, thoughtfully worded survey becomes a relationship accelerator.

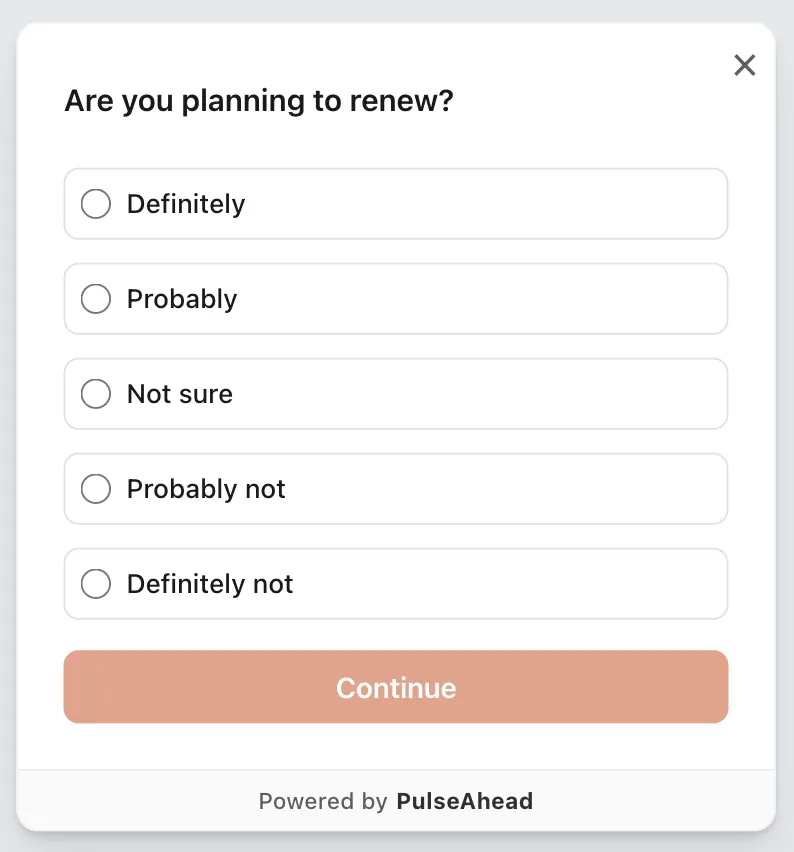

The best pre-renewal feedback doesn’t just measure satisfaction. It uncovers intent and barriers. With a tool like PulseAhead, you’re not just asking customers to rate their experience on a scale of one to ten. You’re asking: “Are you planning to renew?” “What would change your mind?” “What’s preventing you from getting more value?”

Renewal Intent Survey Example using PulseAhead

Direct intent questions work better than NPS alone. Research from customer success communities shows that asking “Will you renew, expand, contract, or cancel?” at the 140-day mark provides clearer signals than NPS alone. It cuts through the noise. A customer might love your product (high NPS), but their budget got slashed by 80% and they can’t afford to renew. That’s the real story.

The sequencing matters too. Start broad. Ask about overall satisfaction and value realization. Then go narrow. What features do they use daily? What frustrated them? What would they change? Questions should build on each other, creating a narrative rather than a checklist.

Keep it short. Seven to ten questions, maximum. Longer surveys get abandoned. The longer your survey, the fewer thoughtful answers you get. Every question should serve a purpose. If you’re not going to act on the answer, don’t ask it.

And here’s the part teams get wrong: don’t send a survey just to forecast. Your customers don’t wake up worried about your renewal accuracy. They want to know that you’re listening and that something happens because they responded. When you gather feedback, close the loop by implementing changes and telling them about it. Research shows that customers are 21% more likely to respond to your next survey when they see their input led to action.

See what's holding users back, Fix it fast.

Building Your Risk Assessment Framework

Effective churn prediction isn’t magic, but it does require structure. Start with segmentation. Not all customers are equally valuable, and not all churn reasons are equal. A customer churning because they found a cheaper competitor needs a different playbook than one churning because they didn’t adopt the product.

Create a tiered approach based on customer value. For enterprise accounts, start renewal conversations six months out with deeper engagement and executive involvement. For mid-market, start at 90 days with standard engagement. For lower-value accounts, 60 days is often enough.

Then layer in your risk triggers. Define thresholds: What health score triggers an alert? How much usage decline equals at-risk status? What combination of factors (low usage, high support tickets, negative feedback) warrants escalation?

Most powerful organizations use a color-coded system or simple categorization. Customers fall into categories: Renew (green), Likely Renew, Neutral, At-Risk (yellow), Will Churn (red). This system gets updated regularly as new feedback comes in, and it’s visible to the entire team so nothing slips through.

Automate the alerts. When a customer crosses into at-risk territory based on your defined triggers, automated notifications go to the right team member with next-step recommendations. This removes the manual monitoring burden and ensures nobody falls through the cracks.

The Intervention: Turning Feedback Into Action

Finding problems is half the battle. Actually doing something about them determines whether the customer renews.

When feedback reveals issues, escalate thoughtfully. Not every problem needs a discount or win-back campaign. Some need product training. Some need deeper implementation support. Some need a price conversation.

This is where having the right tools matters. Instead of managing feedback in spreadsheets and Slack, a centralized platform like PulseAhead lets you collect, organize, and act on feedback at scale. With PulseAhead, you can instantly see that three customers mentioned the same friction point, escalate it to your product team, and then close the loop by notifying all three customers that their feedback led to a specific improvement.

For at-risk customers specifically, create targeted playbooks. If the issue is low adoption, offer dedicated onboarding sessions or product training. If it’s about a missing feature, show them what’s coming in the roadmap. If it’s a support issue, ensure they get white-glove assistance immediately.

The most sophisticated teams link renewal conversations to executive sponsors. For high-value at-risk accounts, involve your leadership in the renewal conversation, not just your customer success managers. It signals commitment.

Creating the Feedback Loop That Actually Works

Feedback is only valuable if it actually changes something. This is where most teams fail.

Start by listening across all channels. With a tool like PulseAhead, you can easily deploy various survey types to get a complete picture. In-product surveys gather contextual feedback while customers are using your app. Email surveys can reach less active users. Net Promoter Score (NPS) surveys help you measure and track customer loyalty over time. By centralizing this data, you can move from reactive support to proactive retention.

Then aggregate it. Look for themes. Which issues come up repeatedly? Which customer segments mention the same problems? Which product areas generate the most negative feedback? Pattern recognition reveals priorities.

Next, act on it quickly. Speed matters. When customers see feedback translating into action within weeks, not months, they feel heard. They’re more likely to stick around and provide more feedback the next time.

Finally, close the loop by communicating back. After you implement changes, tell customers that their feedback prompted those changes. Share the improvements. Thank them explicitly for the input. This cycles your best customers into deeper engagement while showing struggling customers that you’re responsive.

The companies with the highest renewal rates treat pre-renewal feedback as a continuous system, not a one-time event. They collect it, they act on it, and they communicate the impact.

Moving Beyond Gut Feelings to Predictive Confidence

Too many customer success teams manage renewals on gut feel. They hope things are fine until the renewal meeting happens, and then they scramble if they’re not.

The solution isn’t more guessing. It’s systematic intelligence gathering through strategic feedback at the right time.

When you combine product usage data with health scores and pre-renewal feedback, you get a clear picture. You know which customers are truly at-risk months before it matters. You know specifically what’s driving the risk. You know exactly what to do about it.

This confidence changes how you operate. Instead of treating every renewal like a potential crisis, you’re managing a known pipeline. You’re proactive instead of reactive. Your team spends time improving relationships with customers who are genuinely struggling, not scrambling at the last minute.

For teams managing feedback at scale, embedding surveys directly in the product works far better than relying on email alone. When customers see a survey appear while they’re using your app, response rates spike dramatically. The feedback comes while problems are fresh, not weeks later when they’re forgotten. Analytics dashboards then show exactly where sentiment is declining, which customer segments have the lowest scores, and which feedback themes repeat across your base.

The Playbook: Your Pre-Renewal Feedback Process

Here’s what winning teams actually do:

120 days before renewal: Gather baseline data. Review usage metrics, analyze support history, and score customer health. Identify at-risk accounts and normal accounts based on predetermined thresholds.

90 days before renewal: Launch your first feedback round. Send a targeted survey asking about value realization, satisfaction, and renewal intent. Include a direct question: “Do you plan to renew, expand, contract, or cancel?” Segment responses and flag anything red or yellow for immediate follow-up.

60 days before renewal: Deepen engagement with at-risk customers. Schedule check-ins with struggling accounts. Share success metrics showing the value they’ve received. Address specific pain points mentioned in feedback. For healthy accounts, send a quick appreciation message and confirm renewal timing.

30 days before renewal: Finalize terms and prepare contracts. For at-risk accounts still in the balance, involve executive sponsors. Make final value arguments backed by feedback from their own team. For healthy accounts, confirm renewal and discuss any expansion opportunities.

Post-renewal: Close the loop. Tell customers about improvements made based on their feedback. Thank them for responding to surveys. Set the stage for the next cycle.

Why This Works (And Why It Prevents Disasters)

The companies with 90% plus renewal rates aren’t luckier. They’re more intentional.

They start the renewal conversation months early, when there’s still time to actually improve things. They ask for feedback systematically, not randomly. They listen to what’s actually mattering to customers, not what they assume matters. They act on feedback quickly, showing customers they’re responsive. And they track everything so renewal risk becomes predictable instead of surprising.

Skip the guesswork. Start with ready-made Pulseahead templates.

Customers don’t churn by surprise if you’re paying attention. They give you signals. Product usage tells you part of the story. Support tickets tell you another part. But direct feedback from the customer themselves, asked at the right time with the right questions, is where renewal certainty comes from.

The window between today and renewal is your runway to fix things, strengthen relationships, and secure growth. Use pre-renewal feedback to fly that runway with intention, not hope. The teams doing this best are implementing continuous feedback loops, not one-off surveys, treating feedback collection as a core retention competency that runs through their entire customer journey.