Here’s the hard truth: your billboard drove sales. Your radio spot brought in customers. That podcast sponsorship actually worked. But you have no idea how to prove it.

You’re not alone. Marketers spend millions on billboards, radio ads, TV spots, and print campaigns, yet struggle to connect those investments to actual revenue. While digital channels offer pixel tracking and click-through rates, offline advertising exists in a measurement black hole. The result? CFOs questioning budgets, teams slashing campaigns that actually work, and growth opportunities lost because you can’t quantify what’s driving results.

Channel attribution surveys solve this problem. They’re simple, direct, and powerful. By asking customers one straightforward question at the right moment, you unlock the data needed to measure offline ROI accurately and make confident budget decisions.

The Offline Attribution Problem No One Talks About

Traditional offline advertising lives in what marketers privately call “the data void.” Unlike digital campaigns where every click, view, and conversion gets tracked automatically, offline channels like billboards, radio, TV, and print leave no digital footprints.

The measurement gap is real. When someone sees your billboard, hears your radio ad, then visits your website or calls your business, most analytics platforms lose track of that journey the moment they move offline. This creates what one industry expert described as “a black hole in your attribution data, exactly where many of your highest-value conversions occur”.

The traditional methods marketers use to fill this gap simply don’t work well. Vanity URLs get forgotten. Promotional codes go unused. Time-limited attribution windows miss long sales cycles. And relying solely on point-of-sale records ignores the entire journey that brought customers to your door.

Here’s what makes this frustrating: offline advertising often drives awareness and consideration, the critical top-of-funnel activities that digital channels then convert. When you can’t measure offline impact, last-click attribution models give all credit to that final Google search or retargeting ad, completely ignoring the billboard that started the journey.

This misattribution leads to dangerous decisions. Teams cut “underperforming” offline campaigns that were actually filling the funnel. Budgets shift entirely to digital channels that look efficient on paper but can’t sustain growth alone. The offline-online synergy that drives real business impact gets dismantled because you’re flying blind.

Why Channel Attribution Surveys Work

Channel attribution surveys take a refreshingly direct approach to a complex problem. Instead of trying to track customer behavior through technical gymnastics, you simply ask customers how they found you.

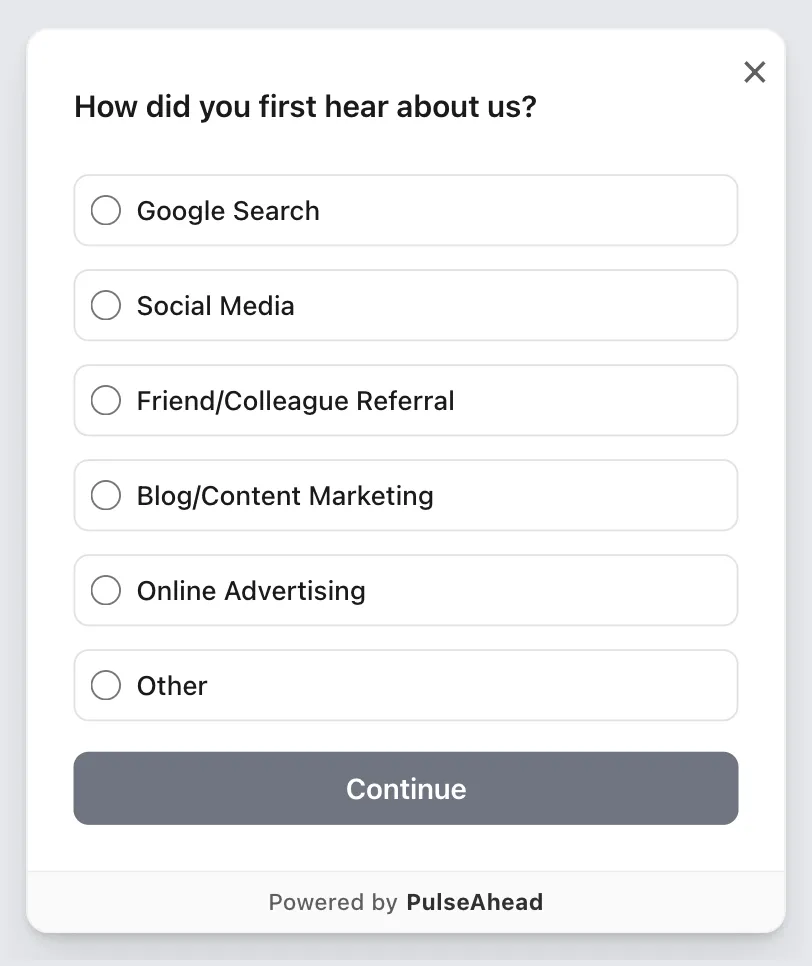

The core question is deceptively simple: “How did you first hear about us?” But when implemented correctly at the right moment in the customer journey, this question becomes one of the most powerful measurement tools available.

Channel Attribution Survey Example using PulseAhead

Survey-based attribution equalizes your marketing measurement across all channels. It captures insights from offline efforts that would otherwise go unmeasured, while also revealing digital channel performance that pixels and cookies might miss due to privacy restrictions and tracking limitations.

The methodology works because it collects what researchers call “zero-party data,” information customers voluntarily and proactively share with you. This makes it more reliable than inferred behavior and immune to the tracking restrictions that plague pixel-based attribution.

Smart marketers have discovered that survey-based attribution reveals 20% more attribution data than traditional web analytics alone by lighting up all the “direct” or “unknown” traffic sources that can’t be traced through technical tracking. It also adds unbiased context to the self-reported data from advertising platforms that, as one marketer put it, “grade their own homework”.

The real power emerges when measuring offline channels. For billboards, radio, TV, and print advertising where technical tracking is impossible or unreliable, surveys provide the only accurate method to connect marketing spend to customer acquisition.

Prove your offline marketing ROI. Get the data you need.

Setting Up Effective Channel Attribution Surveys

The success of your attribution survey depends entirely on execution. Poor survey design creates biased data. Bad timing kills response rates. But get it right, and you unlock measurement precision that transforms how you allocate budgets.

Timing: When to Ask

The post-purchase moment is gold. Customers are engaged, their journey is fresh in their minds, and they’re more willing to share information right after making a buying decision.

For e-commerce businesses, trigger the survey immediately after checkout completion. For service businesses, send it within 24 hours of the first transaction. For B2B companies with longer sales cycles, deploy it after the contract is signed.

The principle is simple: ask when the memory is clearest and motivation is highest. Wait too long, and recall accuracy plummets. Ask too early, and you’re interrupting the conversion process.

The Core Question: How to Ask

Start with the fundamental question: “How did you first hear about us?” This focuses on the initial touchpoint, the awareness moment that started the customer journey.

Provide clear answer options that cover all your active marketing channels. Your list should include both online and offline options like social media, search engines, podcast, radio, billboard, TV, word-of-mouth, referral from friend/family, online review, and direct mail.

Always include an “other” option with a text field. This catches attribution sources you didn’t anticipate and helps you discover unexpected channels driving customers to your business.

Keep the options concise and mutually exclusive. Avoid overlap that creates confusion, like listing both “social media” and “Instagram” as separate choices when Instagram is social media.

Going Deeper with Follow-Up Questions

The magic happens when you add conditional logic to dig deeper based on initial answers. If someone selects “billboard,” follow up with “Where did you see the billboard?” or “Do you remember what the billboard said?”.

This layered approach reveals specific performance within channels. You learn not just that billboards work, but which locations drive the most awareness. Not just that radio converts, but which shows and time slots deliver results.

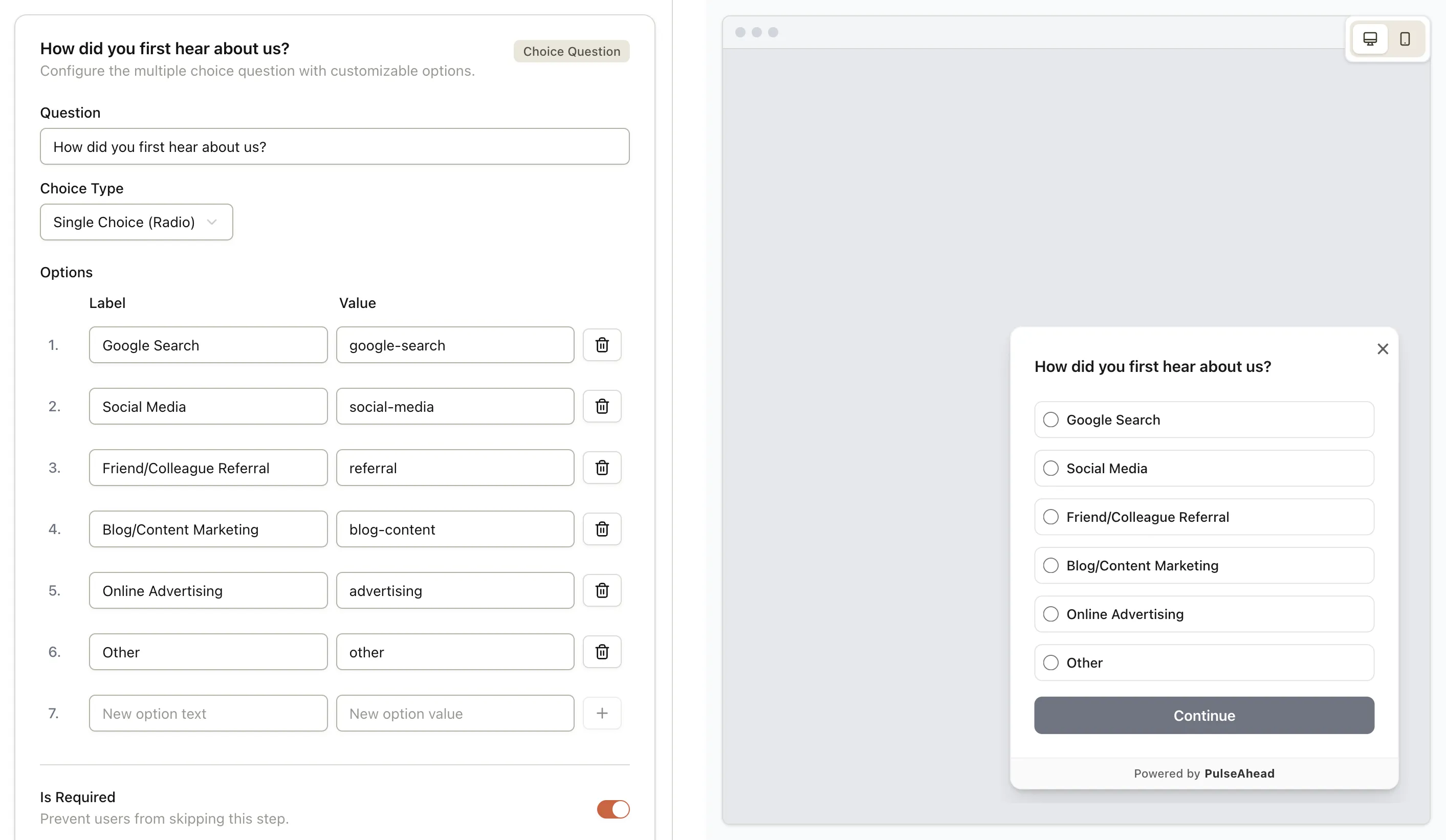

Tools like PulseAhead make this easy through adaptive survey flows that ask relevant follow-up questions based on user answers. This creates conversational experiences that boost completion rates while gathering granular attribution data without overwhelming the user with irrelevant questions.

Use PulseAhead to quickly build and customize your channel attribution survey with ease

Additional Context Questions

Beyond the attribution question, consider asking two supporting questions that provide valuable context.

“Were you actively looking for a product/service like ours when you found us?” helps distinguish between demand capture (they were searching) and demand generation (you created the need). This is critical for evaluating top-of-funnel offline channels like billboards and TV that primarily drive awareness.

“How likely are you to recommend us to others?” (Net Promoter Score) helps you understand which acquisition channels bring the highest-quality customers who become advocates. Some channels might drive volume while others drive loyalty.

Skip the guesswork. Start with ready-made Pulseahead templates.

Calculating ROI from Survey Data

Raw survey responses only become valuable when you transform them into actionable ROI calculations. Here’s how to turn “how did you hear about us” data into budget allocation decisions.

Step 1: Collect and Clean Your Data

Start by aggregating all survey responses over a meaningful time period, typically 30-90 days depending on your purchase cycle and volume. Export this data into a spreadsheet or analytics tool.

Clean the data by standardizing responses from “other” text fields. If 15 people wrote variations of “heard it on the radio,” categorize them all under your radio channel.

Calculate the percentage attribution for each channel. If 100 customers responded and 25 said billboard, that channel receives 25% attribution.

Step 2: Apply Attribution to Revenue

Take your total revenue for the survey period and multiply each channel’s attribution percentage to calculate attributed revenue. If you generated $100,000 in revenue and billboards received 25% attribution, that’s $25,000 in attributed revenue from billboards.

This is where survey-based attribution shines for offline channels. You’re finally connecting specific marketing activities to actual revenue instead of relying on guesswork or broad uplift studies.

Step 3: Calculate Channel ROI

Now divide attributed revenue by channel spend to calculate ROI. If you spent $5,000 on billboards and attributed $25,000 in revenue, your ROI is 5x or 400% return.

The formula: (Attributed Revenue - Channel Spend) / Channel Spend × 100 = ROI%.

Compare this across channels to identify your highest-performing investments. You might discover that while digital channels show strong last-click attribution, your billboards or radio ads deliver superior first-touch ROI by efficiently driving awareness that digital channels later convert.

Step 4: Account for Multi-Touch Journeys

Here’s where it gets nuanced. Survey-based attribution typically captures first-touch (how customers initially discovered you), but real customer journeys involve multiple touchpoints.

A customer might hear your radio ad, see your billboard, then search for you on Google before purchasing. The survey catches the radio ad as first touch, but the billboard and search ad also contributed.

Consider implementing a weighted attribution model that assigns partial credit to channels based on their typical role in your funnel. You might assign 40% to first touch (survey data), 20% to mid-journey touches (analytics data), and 40% to last touch (conversion data).

This blended approach provides the most accurate picture of how offline and online channels work together to drive conversions.

Avoiding Common Survey Attribution Mistakes

Poor implementation undermines even the best survey strategy. Watch for these critical mistakes that create biased or unusable data.

Survey Fatigue and Low Response Rates

If only 5% of customers respond, your data becomes unreliable. Selection bias means the people who respond might not represent your actual customer base.

Combat this by keeping surveys extremely short, using one core question plus one or two optional follow-ups. Every additional question reduces completion rates.

Make surveys mobile-optimized since many customers complete purchases on phones. A clunky mobile experience kills response rates.

Consider offering a small incentive for completion, like entry into a drawing or a discount on future purchases, but avoid incentives so large they attract responses from people just hunting rewards.

Biased Answer Options

The way you phrase and order answer choices influences responses. If you list “Google search” first and “billboard” last, you create primacy and recency biases.

Randomize answer order when possible to eliminate this bias. If your survey tool doesn’t support randomization, manually test different orders across segments to identify bias.

Ensure answer options are specific enough to be useful but broad enough to avoid overwhelming customers. “Social media” with follow-up questions works better than listing every possible platform upfront.

Memory Decay Problems

The longer the gap between first exposure and survey completion, the less accurate the responses. Customers genuinely forget how they first heard about you, especially if they had multiple exposures over time.

This is why post-purchase timing is critical. Fresh conversions mean fresh memories.

For high-consideration purchases with long sales cycles, you might need to ask the attribution question earlier in the journey, perhaps during sign-up or trial activation, when initial discovery is more recent.

Ignoring Assisted Conversions

Focusing solely on first-touch attribution from surveys can undervalue mid-funnel offline advertising that doesn’t create initial awareness but drives consideration and conversion.

A customer might discover you through word-of-mouth (first touch), but your billboard reminded them to act (assisted conversion). Survey data only captures the word-of-mouth attribution.

Supplement survey data with other measurement methods like unique phone numbers for different offline campaigns, campaign-specific landing pages tracked in analytics, and time-based attribution windows that compare sales during campaign periods versus baseline.

Avoid costly attribution mistakes. Get insights with targeted surveys.

From Data to Decisions: Making Budget Calls

The ultimate goal of channel attribution surveys isn’t to collect data, it’s to make better budget allocation decisions that drive profitable growth.

Start by establishing baseline performance for each channel. Your first 90 days of survey data creates benchmarks for attribution percentage, attributed revenue, and ROI per channel.

Identify your highest-ROI channels and test increasing investment. If local radio shows 8x ROI, can you expand to additional stations or dayparts and maintain that efficiency?

More importantly, identify offline channels being starved for budget despite strong survey attribution. These are your biggest opportunities. If billboards show up in 30% of surveys but represent only 10% of your marketing spend, that’s a signal to reallocate.

Watch for offline channels that drive awareness but show weaker last-click attribution in your digital analytics. These awareness drivers are often undervalued in digital-only reporting but critical for feeding the funnel that digital channels convert.

Run controlled tests by pausing specific offline campaigns and measuring the impact on survey attribution percentages and overall conversion volume. If turning off your radio campaign causes search volume to drop, you’ve validated that radio drives demand that manifests in search behavior.

Most critically, recognize that offline and online channels work as a system, not in isolation. The goal isn’t to find one perfect channel but to optimize the mix that creates awareness, consideration, and conversion most efficiently.

Taking Action Today

Measuring offline advertising ROI doesn’t require massive technology investments or complex infrastructure. You can start gathering attribution data within the next week.

Choose one customer touchpoint where you have engagement (post-purchase confirmation, onboarding flow, or first login) and add a single question: “How did you first hear about us?” with answer options covering your active marketing channels.

Run this survey for 60-90 days to collect meaningful data, then calculate attributed revenue and ROI per channel using the methodology outlined above. You’ll immediately see which offline channels deserve more investment and which can be cut or optimized.

For teams ready to move beyond basic surveys to continuous customer understanding that drives retention and growth, PulseAhead’s Channel Attribution Survey Template provides a ready-to-deploy solution. The template includes the core “How did you first hear about us?” question with proven answer options, plus adaptive follow-up questions that gather deeper insights without overwhelming customers.

The template integrates seamlessly into your product with targeting controls that show surveys at the optimal moment, whether that’s post-purchase, after feature activation, or during onboarding flows.

Stop flying blind with offline advertising spend. Ask customers how they found you. The answers will transform how you allocate budgets, prove ROI to stakeholders, and identify the growth opportunities hiding in your marketing mix.

Your billboard worked. Your radio spot drove sales. Now you can prove it.