Influencer marketing has become a multi-billion dollar industry, but here’s the uncomfortable truth that keeps marketers up at night: most teams have no idea if their influencer spending actually works. You see impressive follower counts. You track clicks. You watch engagement metrics climb. But then your CFO asks the inevitable question: “What was the actual return?” and you’re left guessing. The problem isn’t that influencer marketing doesn’t work - it’s that traditional tracking tools were never built to measure it. Last-click attribution hides influencer impact, UTM parameters fail when users don’t click immediately, and promo codes get forgotten. You’re marketing in the dark, allocating budgets based on hunches rather than data. This guide reveals the survey questions and measurement framework that actually captures influencer impact, helping you prove ROI and optimize spending based on real customer behavior.

The Core Problem: Why Influencer Marketing ROI Feels Invisible

Every marketer has experienced this frustration. You partner with an influencer, their content gets thousands of impressions, engagement looks solid, but your conversion numbers don’t budge. Or worse - conversions actually happen, but your analytics tools can’t trace them back to the influencer. This isn’t a failure of your tracking setup. It’s a fundamental gap between how influencers actually drive decisions and how traditional marketing tools measure impact.

Attribution is rarely straightforward. Very few people see an influencer post and make a purchase on the spot. More often, they might search for your brand later, revisit your site days or weeks later, or convert after interacting with multiple influencers. This multi-touch customer journey is the norm, not the exception. When your final conversion comes through a Google search, last-click attribution gives 100% credit to paid search - and zero credit to the influencer who sparked the initial awareness.

Influencers operate in the awareness stage, where their job is to plant seeds, not close deals. The influencer’s post creates interest. The customer then searches, reads reviews, compares alternatives, and only then converts. By the time they convert, the influencer interaction is days or weeks in the past and overshadowed by more recent touchpoints. Your analytics tool never connects the dots because the tools were designed for direct-response campaigns, not awareness-building partnerships.

Different goals require different metrics. One influencer campaign might aim to build brand awareness with a 50% increase in branded search volume. Another targets direct sales with a 10x return on investment. A third focuses on user-generated content and community engagement. Using the same measurement framework for all three would be like measuring a basketball player’s performance with batting averages - the metrics don’t fit the goal. Most teams try to force everything into a conversion-based ROI calculation and end up concluding that influencer marketing doesn’t work.

Platform limitations hide crucial data. Instagram, TikTok, and YouTube don’t give brands full visibility into impressions, reach, or saves. Only the influencer can see these metrics. Your analytics dashboard shows you website clicks, but it can’t tell you how many people saw the influencer’s post and decided to visit your site directly later. You’re missing 80% of the actual influence.

The Missing Piece: Why You Need Direct Attribution Surveys

This is where most teams go wrong. They rely entirely on digital tracking - UTM parameters, promo codes, and analytics tools. These methods capture direct, immediate responses but miss the bigger picture of how influencers shape customer decisions. A survey-based approach to attribution fills this critical gap by asking customers directly what actually influenced them.

Surveys capture what analytics can’t see. When a customer completes their first purchase, ask them: “How did you first hear about us?” Their answer is more honest than any tracking cookie. They remember. They know that they saw an influencer post weeks ago, searched for your brand, read your content, and then bought. They can connect the dots in a way that your analytics tool cannot. This direct feedback reveals the true customer journey, not the fragmented path that pixel-tracking captures.

Multi-touch awareness emerges through surveys. A customer might tell you: “I saw a TikTok from @influencer_name, then saw a Google ad, then read your blog post, then bought.” This tells you that the influencer was the first touchpoint - the crucial awareness moment - even though Google or your blog got last-click credit. Now you know the influencer’s real role: they don’t just drive direct sales, they drive qualified awareness that eventually converts through other channels.

Surveys validate your attribution model. If your survey data shows that 60% of customers discovered you through influencers but your analytics attribute only 15% of traffic to influencer sources, you’ve found your attribution blindspot. This discrepancy is valuable. It tells you that your influencers are working harder than your metrics suggest, and you’re probably underfunding them as a result. Surveys give you the signal to recalibrate.

Timing is critical for survey accuracy. Ask attribution questions during onboarding or at first purchase, when the memory is fresh. Ask months later, and customers forget. Ask during a moment of friction (like a support ticket), and their answers get biased. The best surveys capture attribution intent right when customers are most likely to remember their decision journey accurately.

The Essential Survey Questions: Building Your Influencer Attribution Framework

The foundation of influencer measurement starts with one question, but the power comes from how you ask it and what you do with the answer.

The Primary Question: First Touchpoint Awareness

“How did you first hear about us?”

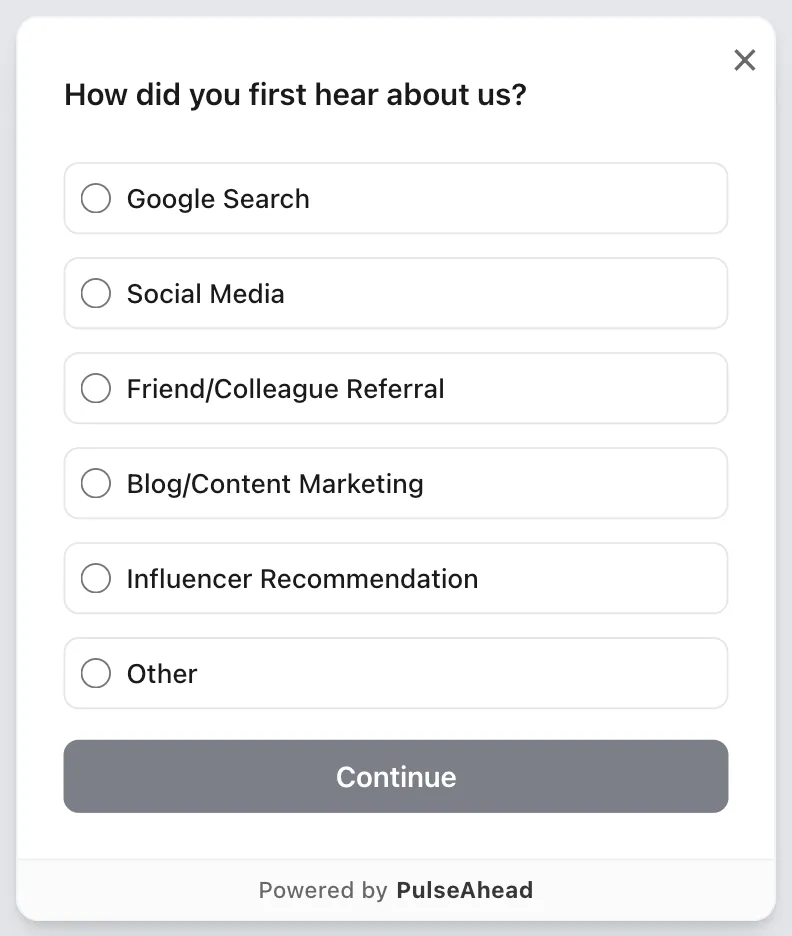

This is the core question that breaks through the noise. Make it the first attribution survey customers encounter, ideally during signup or first login. Offer specific options that match your actual marketing channels: Google search, social media (specify platforms), content/blog, referral from colleague, paid ads, influencer recommendation, direct visit, podcast, email, or other.

The reason you ask about the first touchpoint is that this is where influencers excel. Influencers create awareness and spark the initial decision to learn more about your brand. By capturing this first touchpoint, you measure influencer impact in the stage where they actually work best - not in the conversion stage where they rarely get credit.

This single question unlocks channel performance analysis. Over weeks and months of collecting responses, patterns emerge. You see that 35% of your customers first heard about you through influencers, 40% through Google search, 15% through content marketing, and 10% through referrals. This distribution is vastly different from what your analytics shows, revealing the true influence of each channel.

A PulseAhead survey asking 'How did you first hear about us?' including 'Influencer Recommendation' to track marketing ROI.

The Follow-Up Question: Specificity and Context

“Which influencer or platform did you hear about us from?” (or “Tell us more about how you found us.”)

Once you know that someone discovered you through an influencer, you need specificity. Did they see a TikTok from @creator_name? A YouTube review? An Instagram post? This follow-up converts a general response into actionable insight.

For B2B SaaS companies, the context matters even more. Did they see the influencer on LinkedIn? Industry Slack communities? Specialized forums? These details tell you which influencer ecosystems actually drive your target customers.

Keep this follow-up optional for some users but show it conditionally to those who selected “influencer” or “social media” in the first question. This progressive profiling approach reduces survey fatigue while collecting the granular data you need to optimize partnerships.

The Qualifier: Validating Awareness Quality

“Before this touchpoint, were you aware of [Your Brand]?”

Some survey programs include a pre-qualification: “To help us understand channel effectiveness, did you know about [Brand] before seeing this influencer post?”

This validates whether the influencer truly created awareness or merely reinforced existing knowledge. If a customer already knew about your brand and then saw an influencer post, the influencer’s contribution is different - they might be driving faster conversion, not initial awareness. This distinction changes how you measure influencer ROI and value.

For most influencer campaigns, the answer is “no” - the influencer created genuine awareness. Capturing this data proves influencer impact in a way that clicks and impressions cannot.

Ready to prove your influencer impact? Start collecting real attribution data now.

Building Multi-Touch Attribution With Survey Data

Influencer impact rarely happens in isolation. Customers typically encounter multiple influencers, platforms, and content pieces before making a decision. Survey-based measurement captures these multi-touch journeys in ways that last-click attribution never can.

Layering Attribution Models on Survey Data

Start with the simplest approach: first-touch attribution based on survey responses. This gives influencers credit for creating initial awareness, which is their primary strength. Over time, as you collect survey data from hundreds or thousands of customers, you can overlay more sophisticated models.

Linear attribution using survey data assigns equal value to each touchpoint a customer mentions. If they say: “I saw an influencer post, searched for you, read a blog post, then bought,” each of those three touchpoints gets equal credit. This acknowledges that influencers rarely work alone.

Position-based attribution with survey feedback assigns more credit to first and last touchpoints. If the influencer was the first touchpoint that created awareness, they get weighted credit. If a sales call was the final touchpoint that closed the deal, it also gets credit. The middle touchpoints (content, ads, reviews) split the remaining credit. This model better reflects reality: awareness is hard to create, and so is final conversion. Middle-stage touchpoints are supportive.

Time-decay attribution using survey data gives more credit to recent touchpoints. This works well for longer sales cycles. A customer might say the influencer sparked their interest three months ago, but they converted after a sales conversation last week. The sales conversation gets more credit because it’s closer to conversion. However, the influencer still gets acknowledgment for initiating the journey.

The key is comparing survey-reported attribution to your analytics. Where they diverge, you’ve found an optimization opportunity. Influencers might be more valuable than your attributed ROI suggests.

Segment Survey Responses by Cohort

Don’t look at influencer attribution as a single number. Break down responses by customer segment, geography, product tier, and time period. You might discover that influencers work extremely well for driving awareness among B2B customers but less effectively for SMB customers. Or you might find that TikTok influencers drive higher-quality leads than Instagram influencers for your specific niche.

These segments reveal where to allocate budget. If micro-influencers drive 3x more customer awareness in your target segment than macro-influencers, that changes your influencer strategy. If influencer attribution has increased 60% month-over-month since you changed your messaging, that tells you the updated creative is working.

Measuring Attribution With In-Product Surveys

The most effective approach combines channel attribution surveys with your actual product experience. Instead of sending post-purchase surveys via email, embed them directly into your app or onboarding flow.

In-product surveys have dramatically higher response rates and capture attribution intent at the moment it matters most. A new user completing onboarding remembers their decision journey. They know why they signed up. Ask them directly, and you get accurate feedback that powers real optimization.

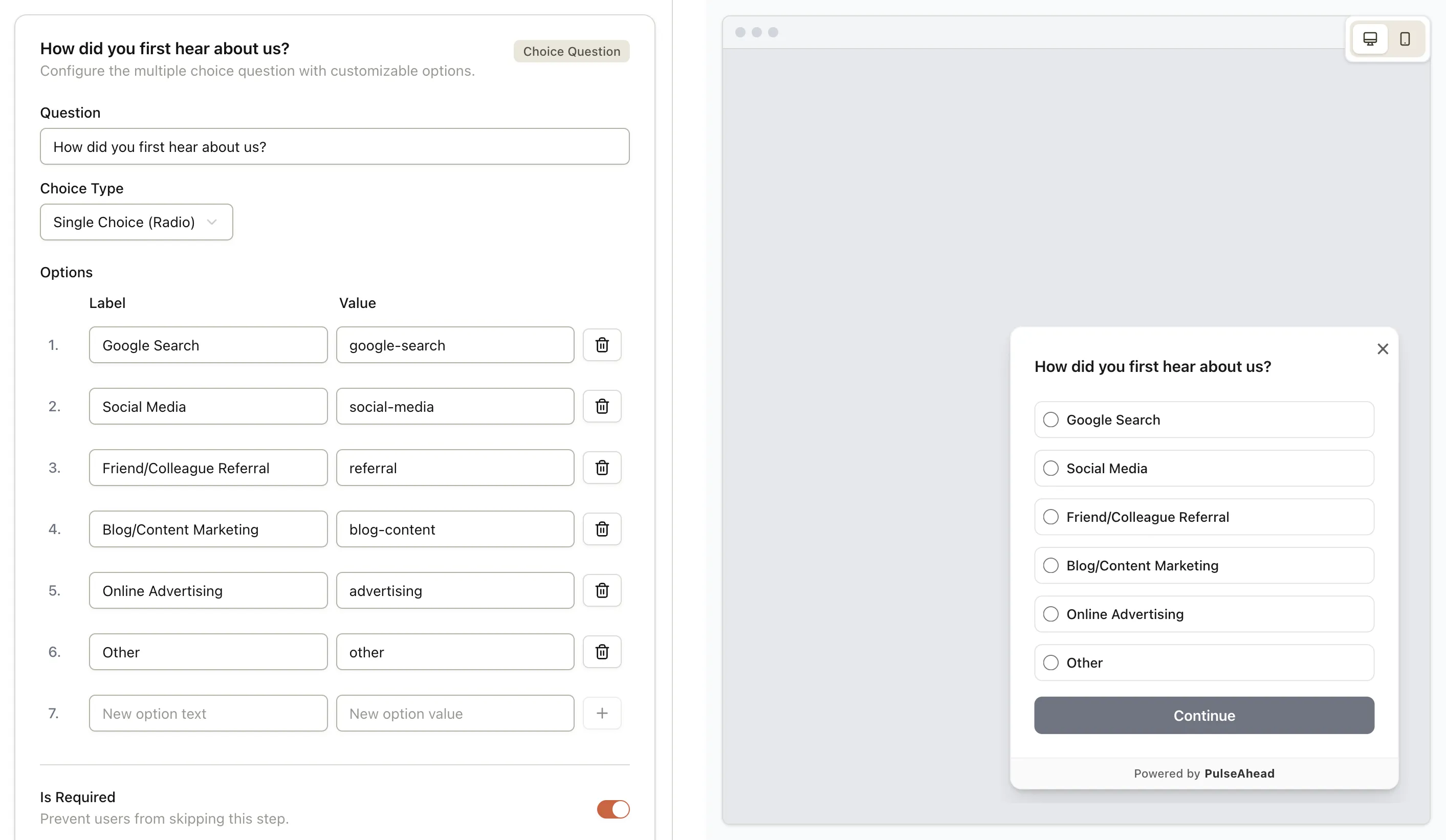

Tools like PulseAhead’s channel attribution survey template make this seamless. You can launch a professionally designed survey directly into your signup flow with minimal technical effort. The survey asks how customers first heard about you, captures follow-up details, and logs responses into a centralized dashboard where you can analyze channel performance, track trends, and optimize budget allocation.

Use PulseAhead to quickly build and customize your channel attribution survey with ease

The platform handles the complexity. You set it up once, and it runs continuously as new users onboard. With PulseAhead, responses automatically populate into analytics that show which channels drive the most aware, qualified customers. You see not just traffic volume but customer quality and lifetime value by channel - the metrics that actually matter for ROI.

Building Your ROI Analysis: From Survey Data to Action

Collecting survey responses is only half the battle. The other half is turning that data into strategic decisions that improve your influencer marketing ROI.

Calculate Influencer-Driven Customer Acquisition Cost

Start by isolating survey responses where customers mention discovering you through influencers. Calculate your influencer marketing spend divided by these attributed customers. This is your influencer-driven customer acquisition cost (CAC).

Compare this to CAC from other channels. If your influencer CAC is $25 but your Google ads CAC is $45, influencers are more efficient. If your influencer CAC is $60 and blog content CAC is $30, you might need to optimize your influencer selection or messaging.

CAC alone doesn’t tell the full story, though. Influencer-driven customers might have higher lifetime value because they come with built-in trust and awareness. A more expensive influencer customer who stays 18 months is more valuable than a cheaper Google customer who leaves after 6 months.

Measure Customer Lifetime Value by Influencer Source

The real ROI equation includes lifetime value. Track how long influencer-attributed customers stick around, how much they spend over time, and how likely they are to upgrade or expand.

If influencer customers have 40% higher lifetime value than average, then your influencer marketing ROI could be 3-4x better than simple CAC calculations suggest. This is especially true for SaaS, subscription services, and businesses with strong retention.

Calculate Incremental Revenue from Influencer Attribution

Beyond CAC and LTV, calculate actual incremental revenue. Survey responses tell you which customers first heard about you through influencers. Track their total spending. This is revenue directly influenced by your influencer partnerships.

Divide total influencer-driven revenue by total influencer spend. That’s your ROI multiple. A 3:1 ratio means every dollar spent on influencers returns three dollars in revenue. A 10:1 ratio means you’ve found a highly efficient channel and should increase investment.

Identify Underperforming Influencer Categories

Survey data also reveals which influencers aren’t working. If you’ve spent $50,000 on nano-influencers but they account for only 2% of customer attribution, that’s a signal to shift budget. If one influencer’s audience discovers you but never converts while another’s audience has 5x higher lifetime value, you’ve identified a partnership to expand.

Segment survey responses by influencer name, follower count, platform, and niche. Look for patterns. Strong performers get more budget. Underperformers get replaced with better-fit creators.

Track Attribution Trends Over Time

Run the same survey questions quarterly or semi-annually. Compare how channel attribution percentages change. Are influencers driving more customer awareness than they were six months ago? Has your blog strategy become more effective? Have referrals increased since you launched a referral program?

These trends tell you whether your marketing strategy is working. If you’ve invested heavily in influencer marketing but attribution isn’t increasing, something needs to change. If attribution is climbing, double down on what’s working.

Common Mistakes to Avoid in Influencer Attribution Surveys

Even with the right survey framework, teams often make mistakes that undermine accuracy and insights.

Asking too late or at the wrong moment. If you ask customers about channel attribution weeks after they signed up, they forget. If you ask during a support incident, they blame the channel that failed them, not the channel that originally inspired them. Timing is critical - ask during signup, first login, or first purchase when memory is fresh.

Making surveys too long. If your attribution survey takes five minutes, response rates plummet. Keep it to 1-2 questions. The first question identifies the channel, the follow-up captures specificity. Done.

Not capturing “don’t know” responses. Some customers genuinely won’t remember how they first heard about you, especially for lower-involvement purchases or longer decision cycles. Offer “don’t know” or “can’t recall” as an option. These responses are data too - they tell you that your brand awareness wasn’t strong or distinctive enough to stick in memory.

Comparing surveys to last-click attribution without context. You’ll almost always find discrepancies. If surveys show 30% of customers discovered you through influencers but analytics shows 10%, don’t panic. This is expected. Surveys capture first-touch awareness. Analytics captures last-click conversion. Both are correct - they’re just measuring different stages.

Over-trusting surveys as the only measurement. Combine survey data with UTM parameters, promo codes, and analytics. When all three methods point to the same conclusion, you have confidence. When they diverge, investigate the gap.

Avoid costly attribution mistakes. Get the insights you need with targeted surveys.

Implementing Your Influencer Attribution Measurement System

Start simple and scale gradually. Don’t attempt to measure everything simultaneously. While the process below can be done manually, a dedicated tool accelerates every step.

Month 1: Add the primary question to your signup flow: “How did you first hear about us?” Collect responses for 2-4 weeks and analyze patterns.

Month 2: Add follow-up questions to capture specificity. If customers select influencer, ask: “Which influencer or platform?” Build out your baseline understanding of influencer contribution.

Month 3: Add segments. Break responses by customer segment, geography, and time period. Identify where influencers work best.

Month 4+: Integrate survey data with CRM data to measure LTV. Calculate actual ROI. Optimize budget allocation based on performance.

With a platform like PulseAhead, you can compress this timeline significantly. Its intuitive survey builder, built-in analytics, and easy integration allow you to move from setup to insights in days, not months. Throughout this process, capture qualitative feedback too. Ask influencer-attributed customers to tell you more about their experience. What did the influencer say that resonated? Why did they choose you over competitors? These narratives inform content strategy and creator selection going forward.

Turning Survey Insights Into Strategy

Attribution data is worthless unless you act on it. Once you understand influencer impact, use that insight to optimize campaigns, select better creators, and allocate budget more effectively.

If surveys reveal that your target audience knows you through influencers in specific niches (fitness, fintech, productivity), focus influencer partnerships there. If certain platforms consistently outperform (TikTok over Instagram for your audience), shift budget toward TikTok creators.

If a particular influencer’s audience drives higher-quality customers (better retention, higher LTV, more upgrades), expand that partnership. If another influencer’s audience attracts low-engagement users, end that relationship and reallocate budget.

The most valuable insight from surveys is this: influencer marketing works better in the awareness stage than in conversion. Stop measuring influencers by direct-response metrics (clicks, immediate sales). Measure them by their ability to create qualified awareness that eventually converts through other channels. This shift in measurement methodology alone often reveals that influencer ROI is 2-3x higher than teams previously believed.

Skip the guesswork. Start with ready-made Pulseahead templates.

Influencer marketing impact isn’t invisible - it’s just hidden from the tools most teams rely on. By implementing survey-based attribution measurement, asking the right questions at the right moments, and comparing responses to your analytics data, you transform influencer ROI from a guessing game into a data-driven strategy. Start with one question: “How did you first hear about us?” Let your customers answer, and watch your understanding of influencer impact shift from skepticism to confidence. With the right tools like PulseAhead, you can finally connect your influencer spend to real business outcomes.