Channel attribution surveys are how modern SaaS teams finally understand which marketing touchpoint actually convinced someone to buy. Not the last click. Not a guess. The real story. The research is clear: 73% of successful deals involve eight or more marketing interactions, yet most teams credit everything to that final branded search click. That’s like giving all credit to the finish line while ignoring the entire race. This article breaks down what channel attribution surveys actually are, why people struggle with them, and shows concrete examples your team can implement immediately to stop leaving money on the table.

The Channel Attribution Problem Everyone’s Facing

Ask any B2B marketer about their pain points, and channel attribution sits near the top of the list. Reddit communities like r/marketing and r/DigitalMarketing are full of frustrated heads of marketing admitting they’ve given up on traditional attribution altogether. One marketing leader actually turned off their entire attribution tracking system and watched the CEO nearly faint. Their reasoning? The system had become worthless. It showed that their largest enterprise client’s discovery path was “direct traffic,” when the reality was they’d listened to forty podcast episodes before reaching out.

That’s the core problem with channel attribution: most tools only see what they can measure, not what actually matters. A customer might discover you on Reddit, spend an hour reading your blog post, spend two weeks in your free trial, and convert after seeing one retargeting ad. Last-click attribution gives 100% credit to that retargeting ad. But the blog post? The Reddit mention that planted the seed? Gone. Invisible.

The frustration is warranted. According to discussions across multiple platforms, teams report spending more time fixing their attribution system than using it for actual insights. Marketers are stuck tracking metrics instead of understanding customer behavior. Fintech leaders, content marketers, and agency heads all report the same issue: their attribution dashboard doesn’t match reality.

What Channel Attribution Surveys Actually Measure

A channel attribution survey asks customers a straightforward question: “How did you find us?” But the magic isn’t in the question. It’s in asking it at the right moment and layering it with context.

The simplest version asks new customers or trial signups one direct question with multiple choice options covering your main channels: Google search, social media, direct link, referral, colleague recommendation, content discovery, or other. Some teams ask an open-ended follow-up: “Tell us more about how you found us.”

The more sophisticated version captures the entire journey. Instead of just asking where they heard about you, it asks about the sequence: “First you learned about us from… then you searched for more information on… and finally you decided to sign up through…” This multi-touch approach reveals the actual customer path, not just the last click.

Real teams are doing this right now. They’re asking during the signup process, right after a trial user schedules a demo, and during onboarding. The timing matters because memory is fresh. Ask someone who signed up three months ago where they discovered you, and they’ll guess. Ask them on day one, and they’ll tell you exactly.

Real Examples of Channel Attribution Surveys in Action

Example 1: The SaaS Company That Discovered Content Marketing’s Hidden Value

A B2B project management tool was running standard attribution tracking and couldn’t justify their content investment. Last-click attribution showed 70% of customers came from paid ads. The content marketing ROI looked dismal.

They decided to add a simple question to their signup form: “How did you find us? (Select all that apply).” Suddenly, the picture changed. They discovered that 65% of signups had interacted with their content before converting, but only 8% of those conversions were attributed to content by their analytics platform. Why? Because almost all of them had clicked a paid ad as their final touchpoint. The blog post had done the actual convincing work. The ad just capitalized on it.

Once they understood this, they adjusted their budget. Content investment went up. Ad spend didn’t decrease, but their efficiency improved because they stopped treating content as “branded awareness fluff” and started treating it as the trust-building engine it actually was.

Example 2: The Community-First Discovery Pattern

A developer tool company noticed something odd in their survey responses: customers consistently mentioned discovering them through Reddit and GitHub discussions, yet their marketing analytics showed almost zero traffic from Reddit. That’s because their customers found Reddit mentions of their tool, researched it independently, and came back directly. The analytics system saw “direct traffic.” The survey saw “Reddit discovery.”

By consistently asking “Where did you first hear about us?” they built a clear picture: Reddit mentions drove 34% of signups, but appeared in their analytics as direct traffic in nearly every case. Once they quantified this, they could make informed decisions about investing in Reddit communities and developer forums where their users naturally hung out.

Example 3: The “It Was A Recommendation” Discovery

A customer success platform launched a channel attribution survey and got a surprising finding: 41% of their customers reported being recommended by a friend or colleague, yet they had no referral program to speak of. This wasn’t a channel their marketing team had been tracking or optimizing. They were essentially getting free customer acquisition with zero structure around it.

The survey made this visible. The company quickly implemented a referral program, gave their happy customers an easy way to recommend them, and turned organic word-of-mouth into a deliberate acquisition engine. Their channel attribution survey had revealed a goldmine hiding in plain sight.

Why Surveys Beat Traditional Attribution Tools (Most of the Time)

Here’s what makes surveys different: they capture intention and context, not just clicks.

Traditional analytics can tell you someone clicked a Facebook ad and converted. But they can’t tell you whether that ad created genuine interest or just capitalized on someone who’d already decided to buy. Surveys can. A customer can tell you: “I saw your ad on Facebook, but I’d already read your blog post two weeks earlier. The blog post convinced me. The ad just reminded me.”

Platform discrepancies also make traditional attribution unreliable. Quora reports different metrics than Google Analytics. Facebook counts clicks differently than your UTM parameters. The more channels you run, the more these discrepancies pile up. A survey cuts through this noise by going straight to the source: ask the customer.

Surveys definitely have their own blindness. They can’t tell you about customers who almost bought but didn’t. And they suffer from recall bias. Ask someone three months later, and they might not remember where they started. The best teams use surveys for qualitative context and traditional analytics for quantitative volume. Together, they tell the full story.

How to Build Your First Channel Attribution Survey

Start simple. Don’t overthink this.

Step 1: Identify Your Channels

List every channel where customers might discover you. For most teams, this includes: organic search, paid ads (which platform?), social media (which platform?), content (blog, docs, webinar), referral, community (Reddit, Discord, forums), direct, and “don’t know.”

Step 2: Choose Your Trigger Moment

When will you ask? The best moments are during signup, after trial conversion, or during onboarding. The earlier the better. Day one is ideal. Day 30 is too late.

Step 3: Keep It Short

One question minimum. Two questions maximum. If you ask more, your response rates crater. Your question should be: “How did you first hear about us?” with channel options. Optional follow-up: “Tell us more” (open text).

Step 4: Ask at Scale

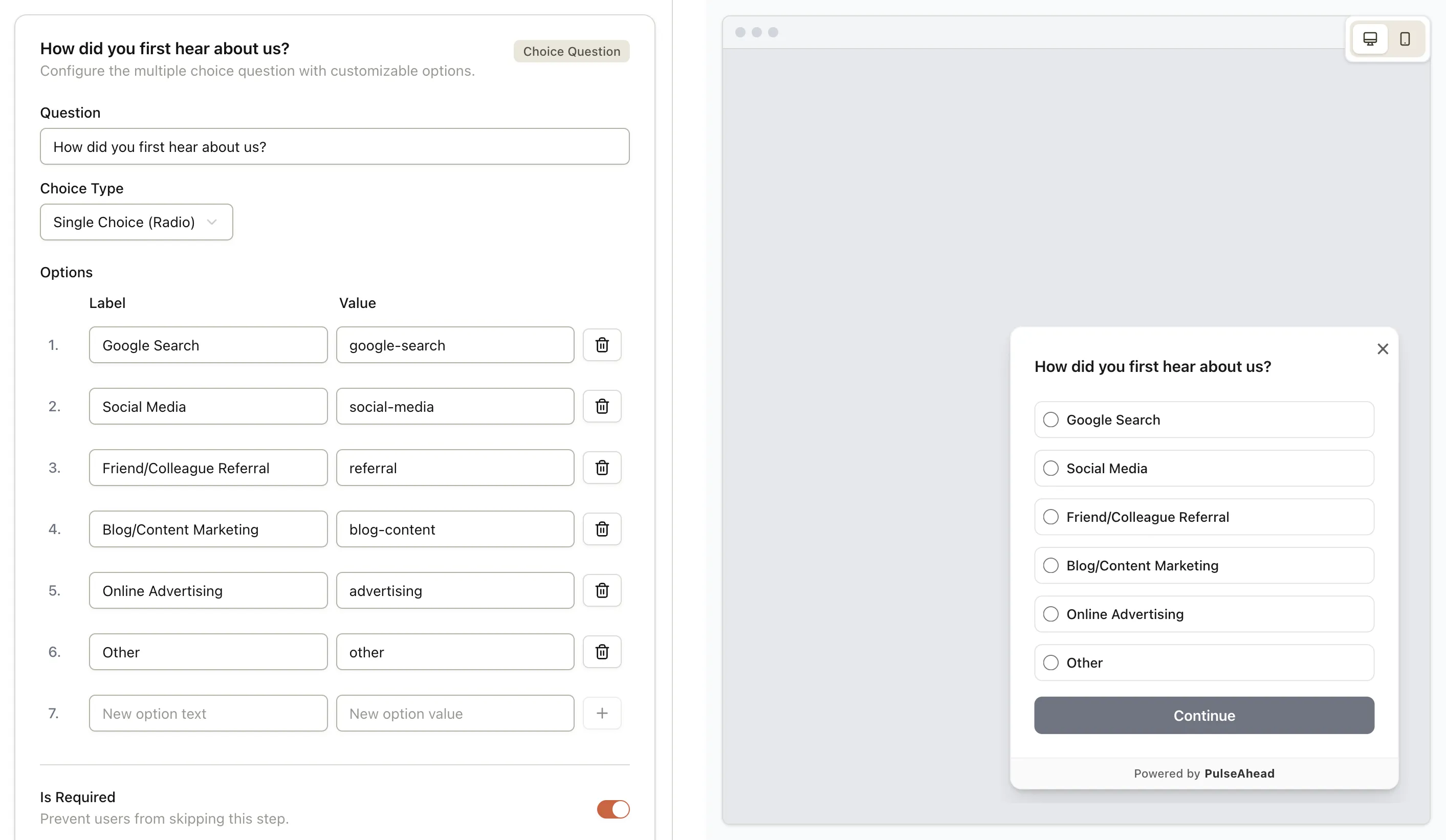

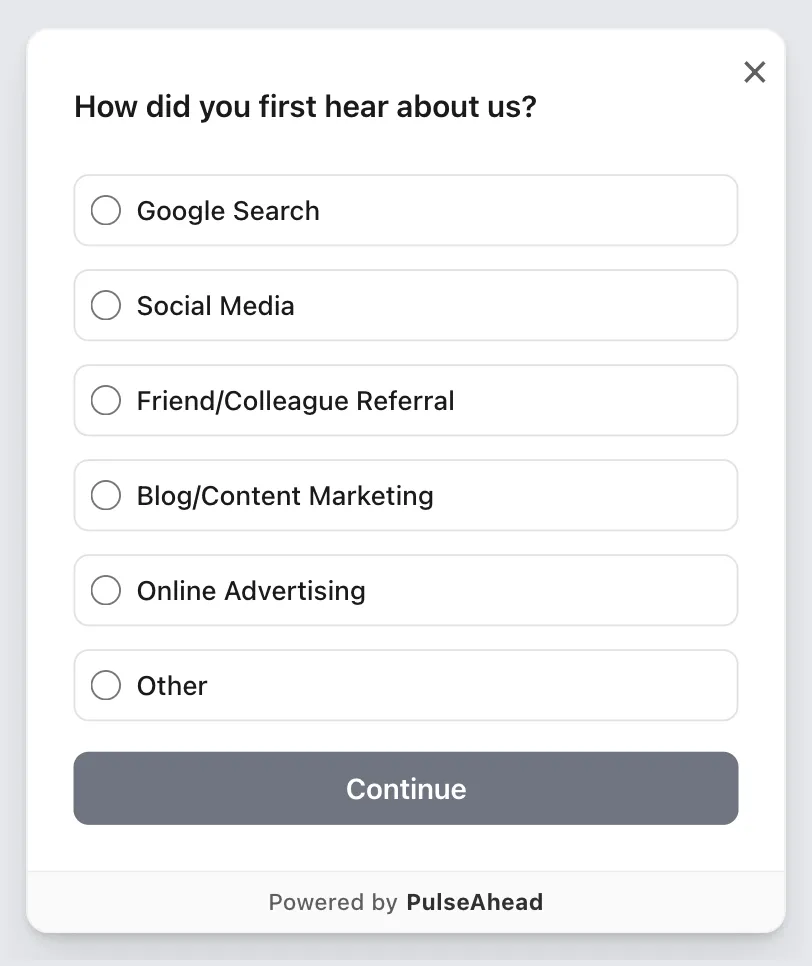

This is where many teams fail. They build a survey but only ask 10% of users because they think constant surveys are annoying. They’re not. In-product surveys, when done right, feel natural. That’s why tools like PulseAhead offer pre-built channel attribution survey templates that you can launch immediately. Embed them directly into your signup flow or app with minimal friction, customize the appearance to match your brand, target specific user segments, and control frequency to avoid survey fatigue. The result? Higher response rates and data you can actually act on.

Step 5: Analyze by Cohort

Don’t just look at averages. Break down responses by time period, customer segment, plan tier, or geography. Paid ads might work great for one industry but poorly for another. Your new user discovery pattern might be completely different from your expansion revenue pattern.

Use PulseAhead to quickly build and customize your channel attribution survey with ease

Making Channel Attribution Surveys Actually Useful

Collecting survey responses is only half the battle. Here’s how to turn them into decisions:

Look for patterns, not individual responses. One person’s answer tells you nothing. Fifty people with the same answer tells you everything. If you see 35% of customers reporting “colleague recommendation” but you have zero referral tracking, you’ve found your opportunity.

Compare survey data to your analytics. If your survey says 40% found you through content but your analytics show only 5% came from your blog, you’ve found an attribution blindspot. This discrepancy is valuable. It tells you that your content is working but getting last-click credit to other channels.

Test interventions based on what you learn. If surveys reveal that “confused about pricing” prevents conversions, test a new pricing page. If they show that “didn’t know this feature existed” is common, test a more prominent feature showcase during onboarding. Let the survey data guide your roadmap.

Track trends over time. Run the same survey quarterly. Are more customers discovering you through organic search? Has your content strategy worked? Are referrals going up since you launched your referral program? The year-over-year patterns show whether your changes are working.

Tools like PulseAhead make this analysis effortless with built-in dashboards that show channel performance breakdowns, attribution trends over time, ROI analysis across different sources, and customer journey insights. You can segment responses by user properties to see how different customer types discover you, making it easy to identify optimization opportunities and measure the impact of your marketing changes.

Skip the guesswork. Start with ready-made Pulseahead templates.

The False Choice: Survey Data vs. Analytics Data

Here’s where many teams get stuck: they treat survey responses and analytics data as competing versions of the truth. One’s right, one’s wrong. That’s a false choice.

Survey data tells you what customers remember and believe about their journey. It’s what marketing actually needs to understand decisions. Analytics data tells you what your tracking system can measure. Both are useful when you treat them as complementary.

The Reddit thread “Multi touch attribution is a mess” featured dozens of marketers admitting they’ve moved beyond traditional attribution entirely toward causal attribution, marketing mix modeling, and incrementality testing combined with survey insights. They’re not ignoring analytics. They’re supplementing it with methods that capture the full picture.

The most practical approach: use surveys to understand the “why” of customer discovery. Use analytics to understand the scale. Together, you get direction and magnitude.

Why Teams Avoid Attribution Surveys (And Why They Shouldn’t)

If attribution surveys are so useful, why don’t more teams use them?

First, friction. Adding another form field or popup feels invasive. Most teams worry about response rates tanking.

Second, poor execution. A badly timed survey (“Tell us how you found us three months after signup”) gets bad data. A survey that’s too long doesn’t get completed. A survey that doesn’t fit the brand feels like a third-party intrusion.

Third, no clear action. Teams collect survey responses, file them away, and never act on them. The insight becomes wallpaper.

The good news: all three barriers are solvable. Start with smart timing (day one is best). Keep it to one question. Connect survey insights directly to your roadmap. When you see patterns emerging across fifty responses, pull in your product team and ask, “What do we do with this?”

That’s exactly what makes solutions like PulseAhead’s channel attribution survey template so powerful. You can launch a professionally designed survey in minutes using their pre-built template, embed it seamlessly into your signup flow with a single code snippet, and get instant access to analytics that show channel performance, trends, and optimization opportunities. The platform handles the technical setup, response analysis, and trend tracking, so you can focus on acting on the insights rather than building the tools.

Your Channel Attribution Survey, Starting Today

Build one this week. Here’s your template:

Question: “How did you first hear about us?”

Options:

- Google search

- Content (blog, guide, article)

- Social media

- Recommendation from colleague

- Direct link

- Paid ad (Google, Facebook, etc.)

- Other (open text)

Trigger: Show after they click “Sign up” but before they create their account. Or on the first page of onboarding.

Follow-up (optional): “Tell us more about how you found us.”

Channel Attribution Survey Example using PulseAhead: Clean, professional survey interface asking customers how they first discovered your brand

That’s it. Implement this and run it for one month. You’ll have 200-500 responses (depending on your volume). Look for patterns. Ask your team: “Does this match what our analytics show? What’s the biggest surprise?” The insights will immediately inform your marketing strategy.

Channel attribution isn’t about perfect measurement. It’s about breaking out of the last-click trap and understanding what actually drives your customers. Surveys do that better than most analytics platforms ever will. Start small, look for patterns, and act on what you learn. That’s how you turn discovery data into growth.